Omnicom's Acquisition Of IPG Faces Potential Ad Industry Unionization And Class Action Lawsuits

Generated by DALL-E

Acquisition Background

The global advertising landscape has witnessed a monumental shift with Omnicom Group's $13.5 billion acquisition of The Interpublic Group of Companies (IPG). This strategic move consolidates two of the industry’s most powerful holding companies, creating the world's largest advertising group by revenue, which is projected to exceed $25 billion annually. The acquisition is a clear response to the competitive pressures of a rapidly evolving market, marked by the rise of artificial intelligence, digital disruption, and the increasing market power of tech giants like Meta.

The acquisition, was driven by a desire for greater scale, synergy, and specialized capability.

Scale and Cost Savings: The combined entity aims to unlock significant financial benefits, with executives initially projecting over $750 million in annual cost savings. This efficiency will be achieved primarily through the streamlining of administrative functions and the consolidation of overlapping agency networks. The integration has already resulted in widespread layoffs, with over 4,000 jobs cut post-acquisition, and the retirement of several legacy brands like FCB, DDB, and MullenLowe, which are being folded into Omnicom’s core networks (BBDO, TBWA, etc.).

Creative and Data Fusion: The merger is a strategic concentration of capabilities. While Omnicom brought world-class creative brands and media muscle, IPG complemented this with strength in data, healthcare, and customer experience (CX) networks. This fusion is intended to create a multidisciplinary client offering, blending traditional brand-building pedigree with modern data-driven and technological capabilities, which the company aims to support with its intelligence platform, Omni.

Market Leadership: By combining the world's third and fourth-largest ad buyers, Omnicom has positioned itself as the undisputed largest global advertising holding company, surpassing rivals like Publicis and WPP in revenue and market influence. The high-stakes nature of the deal required and received regulatory clearance globally, including from the US Federal Trade Commission (FTC), which placed restrictions to prevent anticompetitive coordination.

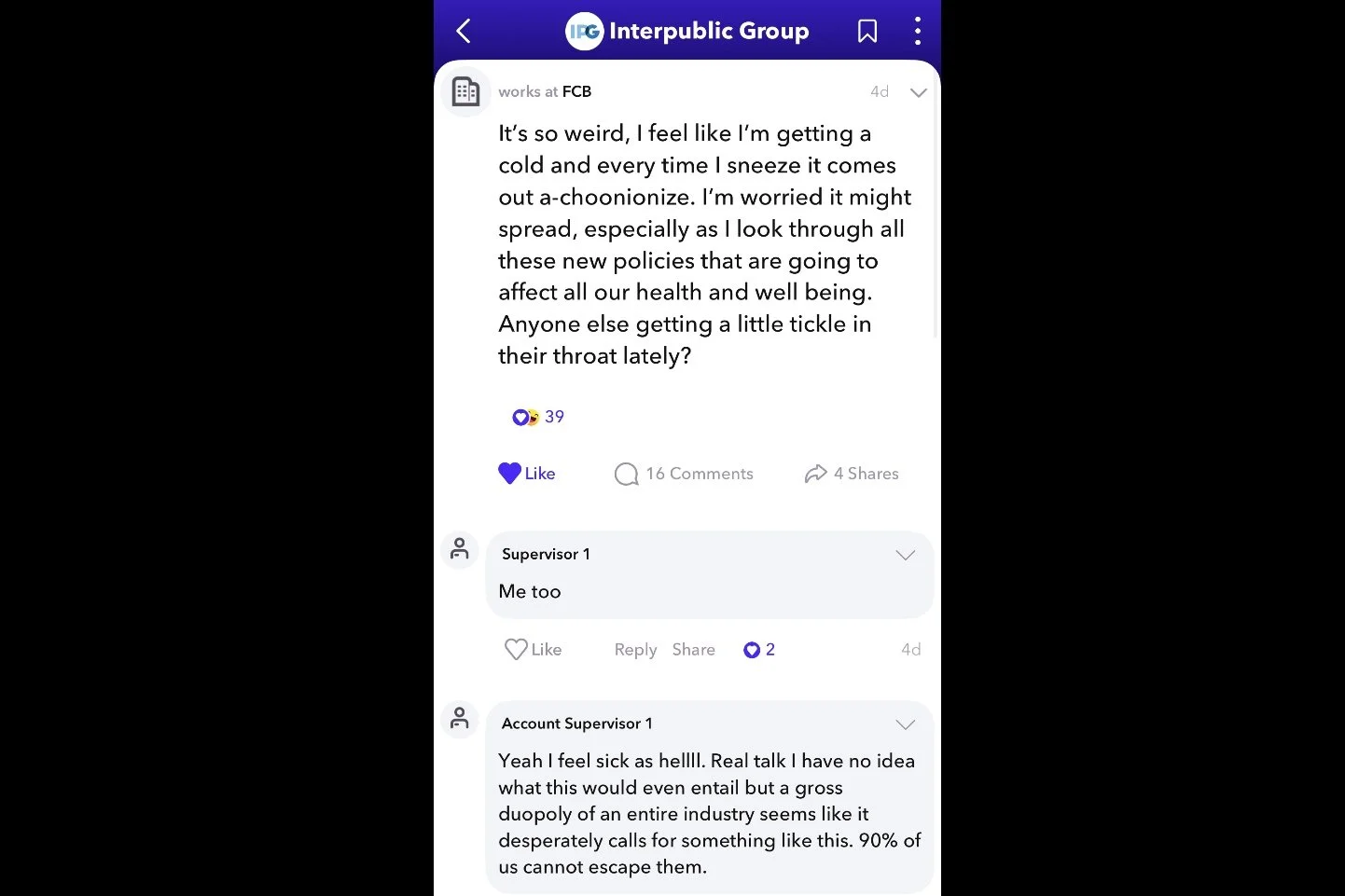

A screenshot from the popular anonymous corporate app Fishbowl, showing high engagement towards a post favoring unionization. This screenshot is from the IPG fishbowl.

Employee Fallout and Benefits Reductions

While the financial markets view consolidation favorably, the real-world impact on employees, particularly those transferring from IPG, has been significant and, according to internal sources, profoundly negative. The immediate and dramatic reduction in employee benefits and workplace flexibility for many is a source of intense internal dissatisfaction and a potential catalyst for unionization or legal action.

The employee-facing changes allegedly include:

Parental Leave Cut: The standard six months of paid parental leave has reportedly been reduced to 10 weeks.

Paid Time Off (PTO) Drastically Reduced: IPG's model of "unlimited PTO" for many roles has been replaced by a system where most employees now receive a set 10 to 20 days, depending on tenure. The loss of previously guaranteed paid days off—including Indigenous Peoples Day, Election Day, the week of Christmas, and wellness days—represents a substantial decrease in total time off for former IPG staff.

Holiday Pay Restrictions: A particularly contentious new rule dictates that if an employee takes a vacation day immediately before or after a holiday, they will not be paid for the holiday itself.

Return-to-Office (RTO) Mandates: A mandatory RTO policy has been implemented, with non-compliance reportedly used as a factor that can negatively impact a departing employee’s severance package.

Increased Health Insurance Costs: Employees have seen increases in health insurance costs, including higher premiums and less comprehensive coverage options.

⚖️The Legal Basis for Class Action Concern

These unilateral and aggregate reductions in compensation and benefits—particularly the reduction in PTO, parental leave, and the punitive RTO clause tied to severance—create a potentially highly litigious environment. The following bullet points describing the basis for various legal action are mostly speculative and unverified but are nonetheless listed below;

Breach of Contract/Promissory Estoppel: While unlimited PTO is often not legally accrued like traditional vacation, the wholesale shift to a standard, limited PTO model, combined with the removal of paid holidays and increased costs for health insurance, can be argued as a breach of implied contract or a violation of promises made during employment.

ERISA and Employee Benefit Plans: Cuts to benefits like health insurance and changes to 401(k) matching (as rumored in some reports) can trigger claims under the Employee Retirement Income Security Act (ERISA), a federal law that governs employee benefit plans. Omnicom has previously faced ERISA class-action lawsuits related to the management of its retirement plan.

The "Substantially Comparable" Clause: Merger agreements often include an "employee matters" clause stipulating that the acquiring company must provide the transferred employees with benefits that are "substantially comparable" to their previous package for a set period (often one year). The sheer number and depth of the benefit cuts alleged by internal employees make a strong case that the new package is not substantially comparable, potentially leading to a massive class-action lawsuit on behalf of former IPG employees.

In a highly competitive talent market, this benefits-stripping strategy risks severely damaging morale, increasing voluntary turnover, and alienating the highly-valued creative and strategic talent that the acquisition was intended to consolidate, all while creating significant legal exposure.