The ECW’s List Of Top Equities To Own: Diversify Your Portfolio with These Winners

Investing in stocks is a smart way to build wealth over time, and choosing the right stocks is paramount to your success. In this article, we'll explore ten stocks that have demonstrated strong growth potential and resilience in various sectors. By diversifying your portfolio with these winners, you can mitigate risks and position yourself for financial success.

Source: Squarespace/Unsplash

1. Meta (Facebook)

Facebook, one of the world's leading social media platforms, stands out as a compelling investment option for various reasons. With an expansive global user base and a dominant position in the digital advertising space, Facebook continues to demonstrate robust growth potential and resilience in the ever-evolving tech landscape.

One key factor contributing to Facebook's appeal as a stock is its ability to consistently innovate and adapt to changing market dynamics. The company's continuous introduction of new features and services, coupled with its strategic acquisitions of emerging technologies, reflects its proactive approach to staying at the forefront of the social media industry. This proactive stance positions Facebook to capitalize on emerging trends and technologies, thereby solidifying its relevance and competitive edge in the digital sphere.

Moreover, Facebook's robust advertising platform serves as a primary revenue driver, leveraging its extensive user data and sophisticated targeting capabilities to offer advertisers unparalleled access to a highly engaged global audience. This advertising prowess, coupled with the platform's ability to effectively monetize its user base, underscores Facebook's strong revenue potential and its capacity to generate sustained returns for investors over the long term.

Furthermore, Facebook's diverse ecosystem, including its ownership of other popular social media platforms such as Instagram and WhatsApp, provides the company with a significant competitive advantage, enabling it to reach a broader audience and diversify its revenue streams. This diversification not only amplifies the company's market influence but also serves as a testament to its adaptability and resilience in navigating the dynamic landscape of the digital economy.

With its strong financial performance, expansive user base, and a demonstrated ability to innovate and evolve, Facebook remains well-positioned to capitalize on the ever-expanding global digital market, making it a promising investment choice for those seeking exposure to the dynamic and lucrative world of social media and digital advertising.

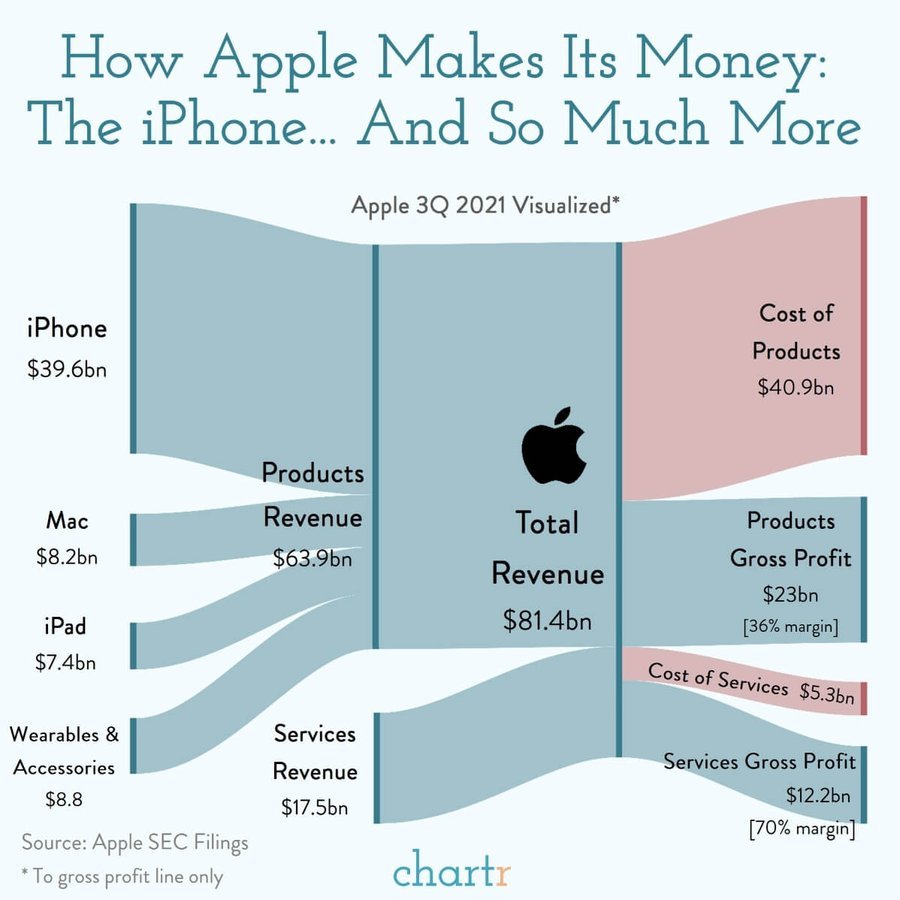

Source: chartr

2. Apple

Apple has been a tech giant for decades, known for its iconic products like the iPhone, iPad, and Mac. The company's focus on innovation, services, and wearables make it a reliable choice for investors seeking stability and growth potential in the tech sector.

Apple commands a substantial market presence across various technology domains and this dominance can be attributed to the company's unwavering commitment to innovation, meticulous design, and user-centric experiences, setting its products apart from the competition.

Apple's reputation as a trailblazer in the tech industry is firmly rooted in its knack for pioneering revolutionary products like the iPhone, iPad, and MacBook. These innovations have not only propelled the company to establish a formidable brand but have also fostered unwavering customer loyalty.

Beyond its past successes, Apple remains at the forefront of emerging technologies such as augmented reality, machine learning, and artificial intelligence. The company's steadfast commitment to research and development has yielded groundbreaking advancements like the iPhone's groundbreaking multi-touch display, which has redefined the landscape of mobile computing.

An integral component of Apple's innovation strategy lies in its ecosystem, seamlessly integrating hardware, software, and services. This tight-knit integration ensures a frictionless user experience across various devices and platforms, further solidifying customer loyalty and retention as cornerstones of Apple's continued success.

Source: OptionsSwing

3. Amazon

Amazon, the global e-commerce and technology giant, stands as one of the most influential and diversified companies in the world. Founded by Jeff Bezos in 1994, Amazon started as an online bookstore but swiftly expanded its reach to encompass a wide array of products and services. Renowned for its customer-centric approach, Amazon has redefined the way people shop and consume content, offering an extensive online marketplace with a vast selection of goods, along with digital streaming services, cloud computing, and even innovative devices like the Kindle e-reader and Echo smart speakers. Amazon's expansive global footprint, robust logistics network, and cutting-edge technology have made it a ubiquitous presence in the modern digital landscape, setting new standards for e-commerce, cloud computing, and digital entertainment, and reshaping the way we live and work.

Amazon is a titan in the e-commerce industry, with a vast product offering, cloud computing services (Amazon Web Services), and a rapidly expanding logistics network. The company's innovation and adaptability in the digital age continue to drive its stock value higher.

From its origins as an online bookstore in 1994, Amazon has evolved into an e-commerce powerhouse that has revolutionized the shopping landscape and exerted a profound influence on the future of retail. Alongside its remarkable business growth, Amazon's stock has exhibited extraordinary tenacity and fortitude, solidifying its status as one of the most resilient and enduring stocks within the market. In this article, we delve deep into the determinants that have bolstered the enduring vigor of Amazon's stock, scrutinizing the company's ingenious strategies, diversified income channels, and forward-thinking leadership.

Source: Squarespace/Unsplash

4. Microsoft

Microsoft's ascent in the tech industry is propelled by its multifaceted business portfolio, and one of its standout stars is the Azure cloud computing division. Azure stands as a formidable force behind the company's burgeoning revenue streams, showcasing robust growth prospects in the realm of cloud services. Beyond Azure's prowess, Microsoft's diversified business lines encompass a spectrum of influential domains, from the ubiquitous Windows operating system and the indispensable Office suite to the dynamic world of gaming.

Furthermore, Microsoft's iconic Windows operating system maintains its prominence as a cornerstone of personal computing. With each iteration, Windows continues to evolve, catering to the evolving needs of users and businesses alike. The enduring relevance of Windows positions Microsoft as a stalwart in the tech industry, tapping into the evergreen demand for operating systems.

Simultaneously, Microsoft's Office suite remains indispensable to millions of individuals and organizations worldwide. The suite's comprehensive suite of productivity tools, including Word, Excel, and PowerPoint, continues to define the standard for office software. Microsoft's ongoing innovations and integration of cloud capabilities into Office 365 ensure that this suite remains at the forefront of modern work environments.

Source: Squarespace/Unsplash

5. Spotify

Spotify, a leader in the music streaming industry, continues to expand globally. Its growing subscriber base and foray into podcasts make it an appealing option for investors interested in the digital entertainment space.

Spotify, the global music streaming service, has emerged as a dominant player in the digital entertainment industry. With a vast library of songs, podcasts, and exclusive content, Spotify has captured the hearts of millions of music enthusiasts worldwide. Beyond its appeal to consumers, the company's solid financial performance and innovative approach to content delivery make it an attractive investment option.

Spotify primarily derives its income from premium subscriptions and ad-supported free-tier offerings. As the number of users and paid subscribers continues to grow, Spotify's revenue channels become more robust, enabling increased investments in content creation, innovation, and market expansion. Moreover, Spotify's emphasis on tailoring user experiences using algorithm-driven playlists and recommendations not only boosts user engagement but also enhances subscription retention rates, thereby playing a pivotal role in driving revenue growth.

Source: Squarespace/Unsplash

6. Disney

The Walt Disney Company, renowned for its iconic franchises, theme parks, and expansive media networks, stands as an enduring beacon of innovation and creativity in the entertainment industry. With a rich legacy that spans generations, Disney has established itself as a global powerhouse, captivating audiences worldwide with its timeless tales and enchanting storytelling.

One of the key pillars that underpin Disney's appeal as a stock lies in its diverse and iconic portfolio of intellectual properties. From the enchanting worlds of Disney Princesses to the captivating narratives of the Marvel Cinematic Universe and the Star Wars saga, Disney's array of cherished franchises has cemented its position as a cultural phenomenon, fostering a deep emotional connection with fans of all ages across the globe. This enduring appeal not only contributes to the company's brand resilience but also serves as a testament to its enduring legacy and widespread market recognition.

Moreover, Disney's strategic focus on expanding its presence in the digital landscape through the introduction of innovative streaming services such as Disney+ and ESPN+ has positioned it at the forefront of the evolving entertainment industry. By leveraging the growing demand for digital content consumption, Disney has successfully adapted to the shifting preferences of modern consumers, establishing a strong foothold in the rapidly expanding world of online streaming and on-demand entertainment. This strategic pivot not only demonstrates Disney's forward-thinking approach to content delivery but also highlights its commitment to remaining relevant and competitive in the ever-evolving digital entertainment landscape.

Furthermore, Disney's commitment to leveraging cutting-edge technology to enhance the immersive entertainment experience for its audience underscores its dedication to pushing the boundaries of creativity and storytelling. From its groundbreaking advancements in animation to its forays into virtual reality and augmented reality, Disney has consistently embraced technological innovation as a means to captivate and engage audiences on a profound level, solidifying its reputation as an industry trailblazer that continually pushes the envelope of what is possible in the realm of entertainment.

With its enduring legacy, strategic focus on digital expansion, and commitment to technological innovation, The Walt Disney Company remains a compelling investment choice for those seeking exposure to the ever-evolving landscape of the global entertainment industry.

Source: Squarespace/Unsplash

7. American Water Works

American Water Works, renowned for its steadfast presence in the utility sector, has established itself as a formidable force, delivering essential water and wastewater services that form the backbone of communities across the nation. Its pivotal role in ensuring the smooth functioning of crucial water infrastructure positions it as a stalwart within the utility industry, offering investors a compelling blend of stability and promising growth prospects.

One of the key factors that underscore American Water Works' attractiveness as a stock is its classification as a regulated utility. This regulatory framework not only provides a shield against market volatility but also instills a sense of predictability and consistency in the company's operations and financial performance. This aspect of regulation serves as a significant draw for investors looking to add stable, low-risk assets to their portfolios while ensuring a steady income stream over the long term.

Furthermore, the perpetual demand for water and wastewater services, irrespective of economic fluctuations, serves as a fundamental driver of American Water Works' resilience and enduring market relevance. As communities continue to rely on these indispensable services for their daily activities and well-being, the company's position at the forefront of this essential industry further solidifies its status as a defensive stock, capable of weathering economic uncertainties and market volatilities.

Additionally, American Water Works' commitment to operational excellence and investment in cutting-edge technologies and infrastructure development reflects its proactive approach to meeting the evolving needs of communities and ensuring the efficient delivery of high-quality water services. This forward-thinking strategy not only enhances the company's operational efficiency but also underscores its potential for sustained growth and innovation within the utility sector.

With its robust regulatory framework, unwavering demand for its essential services, and a commitment to technological advancement and operational excellence, American Water Works remains well-positioned to deliver consistent returns and long-term value to investors, making it a prudent choice for those seeking a reliable and resilient investment opportunity within the utility sector.

Source: Squarespace/Unsplash

8. Match Group

Match Group, a distinguished entity in the realm of online dating, has solidified its position as a leading force in the digital dating market, overseeing a diverse portfolio of platforms that cater to a wide spectrum of user preferences and dating needs. With a robust presence across renowned platforms such as Tinder, Match.com, and others, Match Group has successfully capitalized on the burgeoning trend of online dating, making it an appealing prospect for investors eyeing the digital sphere.

One of the key factors that underscores Match Group's appeal as a stock is its deep understanding of the evolving dynamics of the modern dating landscape. By consistently fine-tuning its platforms and services to align with shifting user preferences and technological advancements, the company has showcased its agility and adaptability, positioning itself as a frontrunner in meeting the changing needs of individuals seeking meaningful connections and relationships in the digital age.

Moreover, Match Group's widespread brand recognition and user engagement within the online dating community further solidify its significance in the market. Its diverse portfolio of platforms caters to a broad spectrum of demographics and preferences, offering users a range of options to navigate the intricacies of modern dating. This inclusivity not only enhances the company's market presence but also underscores its ability to cater to the diverse needs and preferences of a global user base, ultimately contributing to its sustained growth and resilience in the digital dating sphere.

Additionally, Match Group's commitment to user safety and privacy, coupled with its innovative approach to enhancing user experience through the implementation of advanced matchmaking algorithms and user-friendly interfaces, further cements its reputation as a reliable and trustworthy platform within the online dating industry. This emphasis on user satisfaction and security serves as a testament to the company's dedication to fostering meaningful and authentic connections while ensuring a safe and conducive online dating environment for its users.

With its comprehensive understanding of user preferences, commitment to innovation, and emphasis on user safety, Match Group continues to demonstrate its potential for sustained growth and market relevance, making it a compelling choice for investors seeking exposure to the thriving world of online dating and digital relationships.

Source: Squarespace/Unsplash

9. Fisker Inc.

Fisker Inc. is positioned as an alluring contender in the electric vehicle market, presenting a formidable alternative to established players such as Tesla. Renowned for its commitment to blending luxury, sustainability, and cutting-edge innovation, Fisker Inc. has garnered substantial attention from prospective investors and industry enthusiasts alike, signaling a promising trajectory in the realm of electric mobility.

The company's recent Initial Public Offering (IPO) marks a significant milestone in its journey, bolstering its financial resources and providing a robust foundation for advancing its ambitious expansion plans and further developing its diverse electric vehicle lineup. This influx of capital serves as a testament to the growing investor confidence in Fisker's vision and underscores the company's position as a formidable player in the rapidly evolving electric vehicle sector.

One of Fisker Inc.'s distinguishing features lies in its unwavering commitment to sustainability and eco-conscious practices. By prioritizing the integration of sustainable materials and environmentally friendly manufacturing processes, Fisker Inc. has positioned itself as a frontrunner in the pursuit of environmentally responsible automotive solutions, resonating with consumers who prioritize eco-friendliness and sustainability in their purchasing decisions. This strong emphasis on sustainability not only reinforces Fisker's dedication to reducing the carbon footprint of the automotive industry but also reflects its proactive role in fostering a greener and more sustainable future.

Furthermore, Fisker Inc.'s focus on luxury and design excellence has positioned its electric vehicle lineup as a compelling choice for consumers seeking a blend of high-end aesthetics and cutting-edge technology. By infusing its vehicles with premium materials, sleek designs, and state-of-the-art features, Fisker Inc. has carved a niche for itself in the competitive luxury electric vehicle market, catering to discerning consumers who prioritize both style and sustainability in their automotive preferences. This strategic approach not only sets Fisker Inc. apart as a leader in the realm of eco-luxury mobility but also underscores its commitment to redefining the electric vehicle experience through a seamless fusion of opulence and sustainability.

With its strong financial backing, commitment to sustainability, and focus on luxury and innovation, Fisker Inc. stands poised to make a lasting impact in the electric vehicle industry, offering investors a promising opportunity to participate in the burgeoning market of sustainable and luxurious automotive solutions.

Source: Squarespace/Unsplash

10. AbbVie

Abbvie, a renowned pharmaceutical powerhouse, has garnered widespread attention and acclaim within the investment community, primarily attributed to its impressive portfolio of cutting-edge pharmaceutical products, with its flagship drug, Humira, leading the charge. As one of the leading medications in its class, Humira has achieved unparalleled success, solidifying Abbvie's position as a key player in the healthcare industry.

Moreover, beyond the exceptional performance of its star product, Abbvie boasts a robust and diversified product pipeline, underscored by a series of innovative treatments and medications that continue to advance the frontiers of medical science. This diverse portfolio not only ensures the company's continued growth and relevance within the competitive pharmaceutical landscape but also serves as a testament to its commitment to fostering groundbreaking advancements in the field of healthcare and medicine.

In addition to its strong product pipeline, Abbvie stands out for its unwavering commitment to research and development, dedicating significant resources and expertise to the pursuit of groundbreaking medical solutions that address a wide array of health challenges. This steadfast dedication to innovation positions Abbvie as a trailblazer in the healthcare sector, contributing to its overall appeal as a stable and promising investment opportunity for discerning investors seeking to capitalize on the potential of the pharmaceutical industry.

Backed by robust financials and a track record of consistent growth, Abbvie has demonstrated resilience and stability even in the face of dynamic market conditions, further cementing its status as a reliable and lucrative investment option within the ever-evolving healthcare sector. With its strong market presence, diversified product offerings, and commitment to pioneering research and development, Abbvie remains poised to continue its upward trajectory, making it an attractive prospect for investors looking to capitalize on the promising opportunities presented within the pharmaceutical market.

Conclusion

Diversifying your investment portfolio is essential for managing risk and achieving long-term financial goals. The ten stocks mentioned above represent a range of sectors, from technology and entertainment to utilities and healthcare. While these companies have demonstrated their potential for growth and resilience, it's crucial to conduct thorough research and consider your investment goals and risk tolerance before making any investment decisions. Additionally, consulting with a financial advisor can provide personalized guidance to help you build a well-rounded and diversified investment portfolio.